I wrote a lengthy post in Danish yesterday following a Twitter discussion with Kenneth Praefke, a journalist who wrote what is probably the worst Danish article on economic policy in 2013 (not that I made a top 10 list or anything). The background is that since the 1980s, the Danish krone has been pegged in a fairly narrow band to the Deutsche mark, and to the euro since 1999. This means that unless the peg is abandoned, Denmark does not have the ability to carry out its own monetary policy.

Such a peg is not unusual for a small country. Personally, I don’t think it would be deep heterodoxy to suggest that the peg has advantages and disadvantages for Denmark. What has actually happened is strange: monetary policy has not been a factor in Danish economic policy for so long that Danish politicians, economists and reporters have completely forgotten that it exists, and that in most countries, it is a natural part of the overall economic policy.

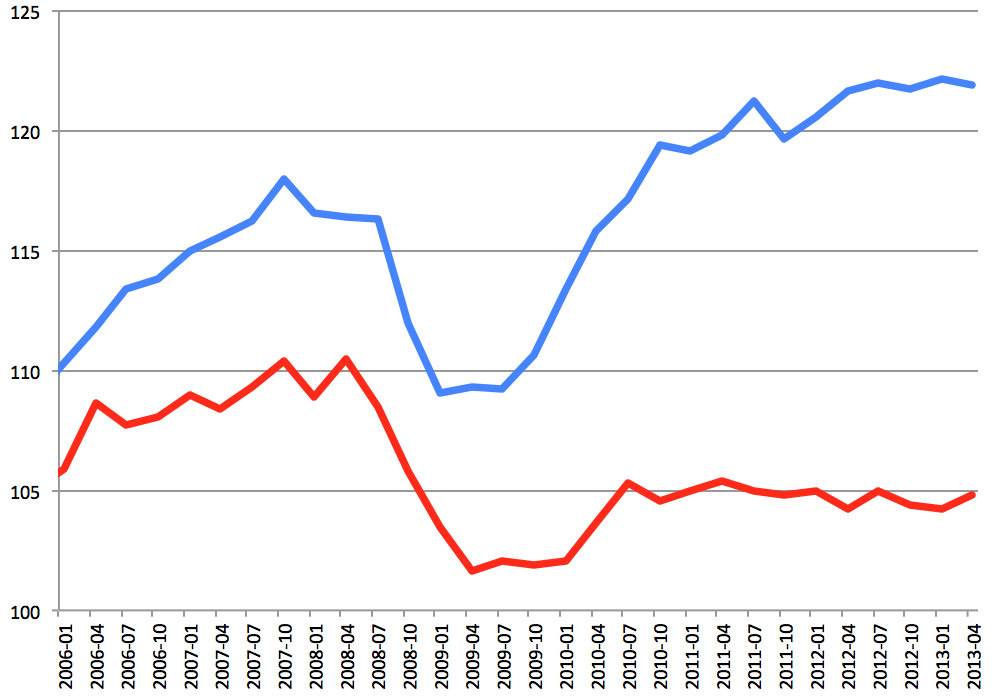

Behold, now, Mr. Praefke’s article. The headline is: “Economists: Sweden is not an economic role model”. It starts with the premise that various Danish politicians have pointed to the fact that Sweden has weathered the 2007–? economic crisis better than Danmark, and suggested that perhaps we should learn something from the Swedes. Here’s a chart of Swedish and Danish real GDP (indexed to the 2000–5 average):

He then quotes two economists, Torben M. Andersen and Martin Madsen, who state that the Swedes have not carried out any significant structural reforms that can explain the difference. Labor market reforms in Sweden lag behind Denmark and top marginal tax rates are not lower. Torben M. Andersen goes so far as to say, “In my opinion there are no magic tricks that one could say they’ve pulled out of the hat in Sweden.” We don’t have a transcript of the interview, so it’s possible that it was very clear that the conversation was only about structural reforms, but that’s not the impression given in the preceding paragraphs.

The fact that Sweden has had an excellent monetary policy carried out by the world’s foremost monetary policy magician is not mentioned at all. On Twitter, Kenneth Praefke explains the omission by claiming that he set out to write an article on structural reforms, and good monetary policy is not a structural reform.

Praefke’s very successful attempt at ignoring the monetary elephant in the room is only a symptom of a syndrome of monetary policy amnesia in Denmark. It’s telling that the Danish politicians he quotes in the beginning would like to emulate Sweden’s handling of the crisis. They’re not stupid, so they probably thought about what the Swedes might have done better, and then they realized: we can’t talk about that.

While money has been entirely forgotten in Denmark, there is still some countercyclical fiscal policy. Most of the economic policy debate, however, deals with structural reforms. Reform, reform, reform. Sweden hasn’t reformed as rapidly, so they suck. All anyone can talk about in policy circles these days is the government’s new Productivity Commission, whose members are charged with boosting productivity. Meanwhile, the country is left with some excellent (though sometimes excessive) reforms and some odd articles about economics.