Since this is a post about game theory, I should probably say by way of disclaimer that it’s been three or four years since I’ve solved for a Perfect Bayesian Equilibrium. It appears to have been even longer for Felix judging by his game theoretical analysis of #mintthecoin, the platinum coin that will save us all from doom.

Justin Wolfers was first to point out that something is fishy. At the top of the post is this 2×2 matrix:

|

Don’t mint |

Mint the coin |

| Threaten to mint the coin |

Bluff

| Open Defiance |

| Don’t threaten |

Negotiate

| Last Resort |

Normally when you see a matrix like this under the heading “game theory”, you think it’s the reduced form of a game, where the rows are the possible strategies of player A and the columns are the possible strategies of player B. In the cells you have the outcomes (profits or utilities) for each player. Here’s an example from the Wikipedia article on the prisoner’s dilemma:

|

Prisoner B silent |

Prisoner B betrays |

| Prisoner A silent |

Each serves 1 year |

Prisoner A: 3 years

Prisoner B: goes free |

| Prisoner A betrays |

Prisoner A: goes free

Prisoner B: 3 years |

Each serves 2 years |

All the key elements of a game are here: there are at least 2 players, each of whom have at least 2 strategies available, and the “middle” of the matrix labels the outcomes for each player, which depend on the strategies of the other players. Without these elements, it’s not a game, but a decision problem.

What Felix describes in his matrix is not outcomes of a 2-player game, but rather strategies for a single player at two different stages of the game. Games with multiple stages are generally represented in extensive form, rather than reduced form, but that doesn’t change the fact that he hasn’t considered how the House Republicans would react to a threat or non-threat to mint the coin, and how outcomes would depend jointly on the Treasury’s and Republicans’ actions. If, as Felix suggests, the Treasury should adopt the strategy of not threatening to mint the coin and also not minting the coin, then we need to know what he thinks will happen if negotiations fail and default is imminent.

(I say “default” and don’t consider the option of prioritizing payments because it’s clear from the BPC analysis that prioritization would be logistically difficult and the Treasury may not have enough cash to even cover interest payments due on February 15 and 28 even if no other bills are paid. If you think there’s some possibility that I’m wrong about this, that could be modeled in the game, or you could simply change the assumption.)

I actually think the game could have more than 2 stages. The Treasury could:

- Threaten to mint the coin now.

- Threaten to mint the coin on the eve of default.

- Mint the coin just in time to avert default.

- Wait and mint the coin a week or two after default.

- Cave and agree to a debt limit increase with spending cuts.

At various stages of the came, the House Republicans could:

- Do nothing.

- Pass a “dirty” debt ceiling increase.

- Pass a clean debt ceiling increase.

- Pass a bill abolishing both the debt limit and the platinum minting authority.

I’m leaving out some of the possible actions that are purely negotiating tactics, but they might be important if they affect political outcomes for players.

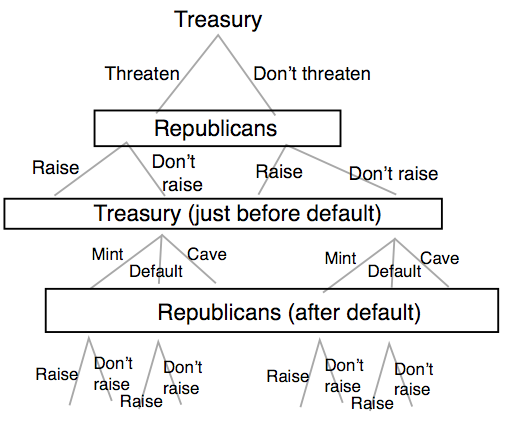

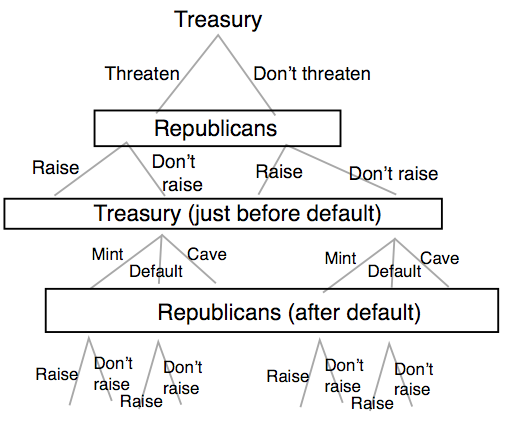

Here’s my simplified extensive form that doesn’t include all the options above, with the player with the move on the nodes and the moves on the edges:

To actually solve this game, I’d need to assign utilities to each of the terminal nodes. They would be based on both political and economic outcomes. We can assume that the Treasury really wants to avoid default. I might also need to introduce some uncertainty about how the market would react to default, and uncertainty about the political preferences of the players. We could also introduce the option of the Treasury rejecting the platinum coin option now to make the game even more complicated, and we could introduce the Fed and the courts as players.

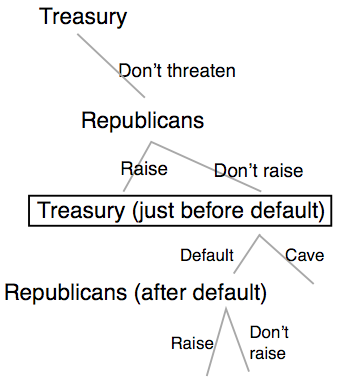

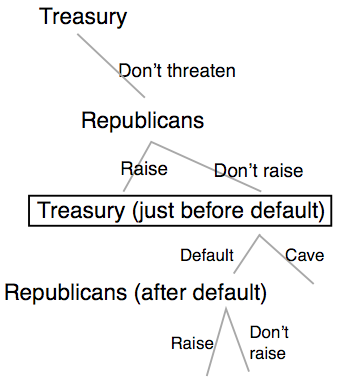

We can’t solve the game fully without further assumptions, but we can evaluate some of the strategies. Felix is arguing that regardless of the Republicans’ reaction, the Fed should not threaten to mint the coin and also not mint the coin, under any circumstances. That means we’ll end up with this game:

I think that at the final stage, if the Republicans don’t raise the debt ceiling even after a catastrophic default, Obama would cave on spending cuts, but the Republicans would look bad. Your solution to the game then depends on how much political damage House Republicans would take from that outcome.

Another complication is that unless the debt ceiling is simply abolished, this will be a repeated game. If the Treasury caves just before default, the Republicans know that they’d probably do it again next time, which means they will always wait until the last minute to raise the debt ceiling. The repeated nature of the game is probably the most important aspect and the foundation for one of the best arguments for minting the coin: we should accept some silliness so we can abolish the dangerous default option forever.